Why are companies like Chase Bank, PayPal, COOP, and Uber announcing new commerce and retail media platforms almost every week? The answer lies in the impending illegalisation of third-party (3P) cookies. This has significantly increased the value of first-party (1P) data, collected via 1st party (1P) cookies. Before discussing the implications for advertising, let’s briefly explain what 3P cookies and 1P data are.

What are cookies?

Cookies are small scripts attached to a website or app. They collect data on users, such as the pages they visit, their location/IP, and the duration of their visit. The crucial distinction is who holds this data: 1P data is collected by the website or app owner, while 3P data is collected by external entities indirectly affiliated with the site via third party cookies. 3P cookies allow multiple data collectors to track users across websites/apps, raising significant privacy concerns and leading to their phase-out. Digital advertising and other marketing activities then use this tracking data for targeting.

The importance of 1P data

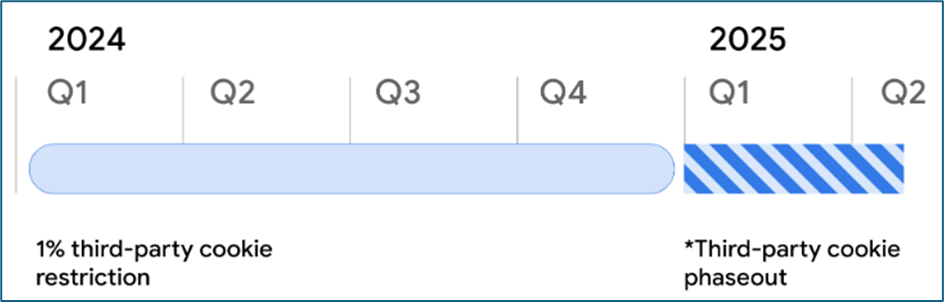

This phase-out isn’t new. Firefox and Safari have limited 3P tracking since 2019, but Google Chrome, with over 705 of browser traffic, is the most significant holdout. The loss of 3P cookies has been shown to significantly reduce ad efficiency.

This shift brings first-party data to the forefront, offering a rich and detailed understanding of audiences directly collected by the website or app owner. Historically, 1P data has been limited in scale and less comprehensive compared to 3P data. However, as 3P cookies are phased out, 1P data will become crucial to fill the gap.

Many businesses with substantial 1P data are now offering this data through media platforms, enabling advertisers to engage anonymously yet precisely. Despite this, challenges remain in scaling and achieving a holistic view of the shopper.

Amazon’s first party data

Amazon stands out with its extensive 1P data. As an online-first platform, it has a deep understanding of browsing habits and purchase intent. Even when purchases don’t occur on Amazon, many shoppers use it for information gathering. In the UK, Amazon has up to 90% penetration of all households, providing a default wealth of purchase data tied to location, frequency and basket details. The integration with entertainment platforms like Prime video, Twitch, IMDB and Amazon Music gives Amazon unparalleled insights into both shopping and entertainment preferences, making it unique among 1P platforms.

Amazon advertising dominates retail media spend and has introduced Ad Relevance. This is an AI-driven tool that uses contextual and AI shopper signals to engage shoppers without 3P cookies. However, Amazon isn’t the only player in the game.

Alternatives for targeting advertising without cookies

Below is a video featuring Ladipo Fagbola and Andy Parr discussing alternative solutions to 3P cookies available to advertisers.

Video exploring alternatives to 3P cookies for advertising targeting